Anxieties Dominate the Horizon

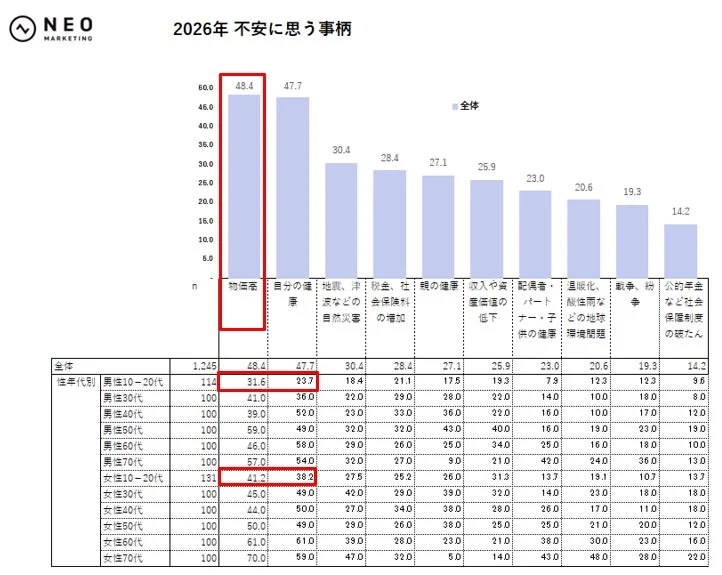

The survey highlighted “cost of living” (48.4%) and “personal health” (47.7%) as the two predominant anxieties for 2026, significantly outweighing concerns about “income or asset value decline.” This suggests that daily expenditure increases are likely to be a more immediate driver of purchasing decisions than broader economic sentiment. A striking revelation was the early onset of health anxiety among women; as early as their 10s and 20s, “personal health” (38.2%) nearly matched “cost of living” (41.2%) as a concern. This trend continues with high levels through their 30s, 40s, and 50s, indicating that health worries emerge earlier and persist longer for women. This might be due to a heightened awareness of bodily changes and future life events, fostering a proactive desire to maintain well-being.

A Saving-Oriented Consumer Landscape

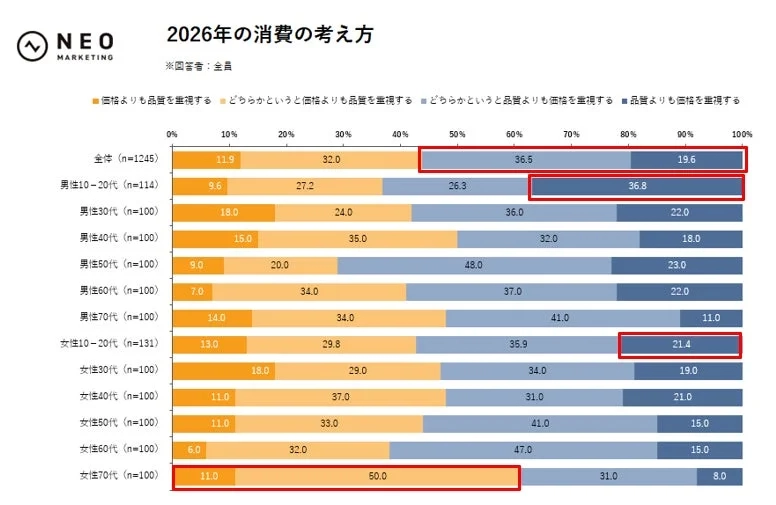

When it comes to consumption, over half of respondents (56.1%) indicated a preference for “price over quality,” signaling a pervasive saving-oriented mindset for 2026. This trend is particularly pronounced among young men in their 10s and 20s, with 36.8% prioritizing price significantly. Conversely, women in their 70s showed a stronger inclination towards “quality over price” (61.0%), suggesting a desire to maintain comfort and reliability in essential purchases despite rising costs. This generational and gender-based divergence in purchasing philosophy underscores the complex consumer landscape.

Diverse Spending Priorities Amidst Caution

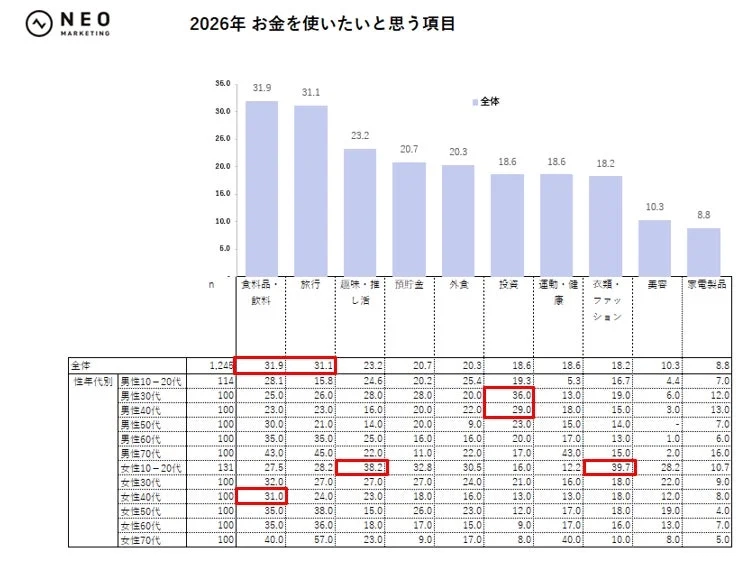

Despite widespread economic anxieties, consumers are not shying away from all expenditures. “Food and beverages” (31.9%) and “travel” (31.1%) emerged as the top two categories where people intend to spend money in 2026, reflecting a balance between daily necessities and a desire for enriching experiences. Significantly, “savings” (20.7%) and “investment” (18.6%) also ranked high, indicating a strong dual focus on both spending and preparing for the future.

A closer look reveals distinct spending patterns by demographic. Men in their 30s (36.0%) and 40s (29.0%) showed the highest interest in investment, often mentioning specific instruments like NISA, investment trusts, iDeCo, and S&P500. This suggests a proactive approach to wealth building among core working generations. Meanwhile, young women in their 10s and 20s displayed a strong inclination towards “hobbies/fandom activities” (oshikatsu, which refers to dedicated activities supporting one’s favorite idol, character, or artist) at 38.2%, and “clothing/fashion” at 39.7%. This highlights a continued desire for self-expression and engagement with personal passions, even in an economically cautious environment. One survey participant, a young woman in her 10s-20s, shared her specific interest: “I want to spend on live goods and magazines of my favorite idol.” This sentiment encapsulates the vibrant spirit of oshikatsu culture, where emotional investment often transcends immediate economic concerns.

Evolving Relationship with Tech and Information

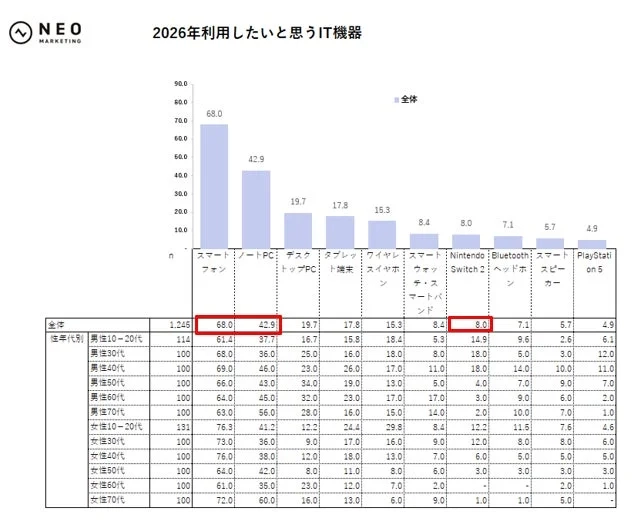

The survey also tracked changes in IT device and generative AI usage. While smartphones and notebook PCs remain widely used, there’s a notable decline in the desired future use of these general-purpose devices, from 88.4% to 68.0% for smartphones and 55.3% to 42.9% for notebook PCs. This could suggest a growing sentiment among consumers to reduce screen time or a preference for more specialized tools. For example, the “Nintendo Switch 2” saw a slight increase in desired usage (from 5.5% to 8.0%), indicating a sustained appetite for dedicated entertainment experiences.

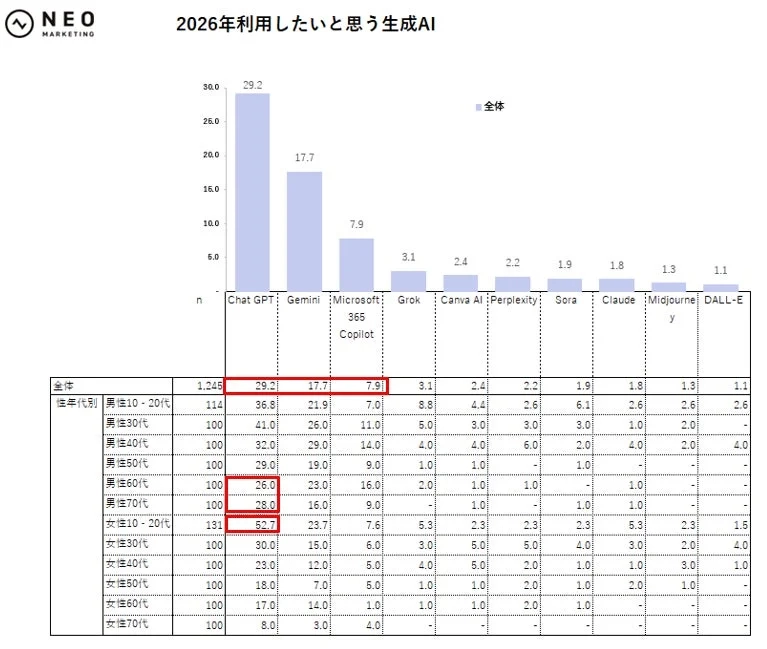

In the realm of generative AI, leading platforms like ChatGPT, Gemini, and Microsoft 365 Copilot are expected to see a slight increase in utilization. For instance, ChatGPT’s desired use rose from 28.1% to 29.2%. Young women in their 10s and 20s are particularly engaged with ChatGPT (52.7% current usage), while male seniors in their 60s and 70s are also showing increasing interest. This broadens the demographic for AI adoption beyond tech-savvy early adopters.

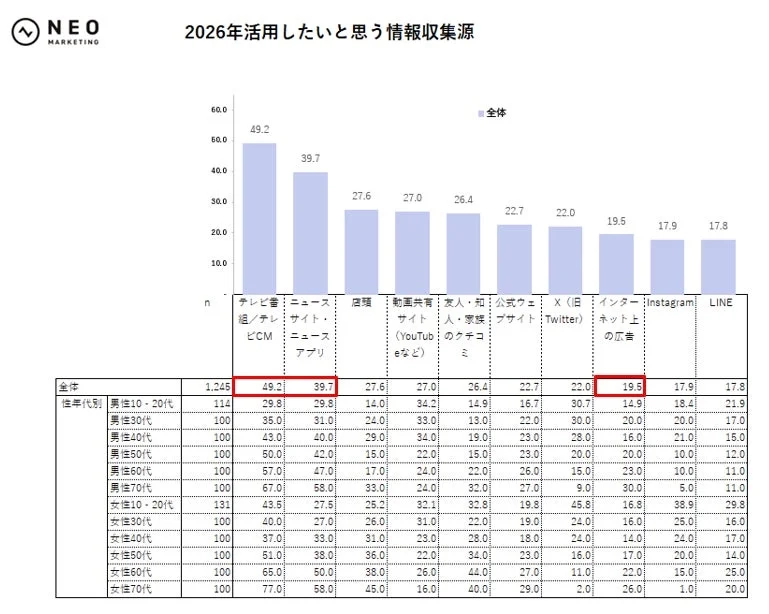

Regarding information sources, while traditional media like “TV programs/CMs” are currently dominant, there’s a projected decline in their desired future use (from 63.5% to 49.2%), alongside “internet advertisements” (32.2% to 19.5%). Conversely, “news sites/apps” maintained relatively stable desired usage, suggesting a preference for concise, to-the-point information. An increasing number of respondents reported “no particular source” for future information gathering (from 12.7% to 19.9%), hinting at a potential fatigue with information overload and a desire for selective consumption.

What This Means for Kawaii Culture Abroad

The survey results, while not directly addressing “Kawaii” culture, offer intriguing insights into its potential trajectory. The strong emphasis on “hobbies/fandom activities” and “clothing/fashion” among young Japanese women, even in a cost-conscious environment, suggests that emotional investment in self-expression and beloved characters remains a powerful driver. For the global Kawaii community, this indicates a resilient market for merchandise, fashion, and experiences centered around cute aesthetics. As Japanese consumers become more selective with their spending and information intake, authenticity and genuine connection, hallmarks of Kawaii culture, will likely become even more valuable. The future of Kawaii abroad might see a continued embrace of niche, high-quality items and experiences that deeply resonate with individual passions, rather than broad, mass-market trends, evolving into a more personalized and emotionally rich cultural phenomenon.

Further Information

-

Original Report: https://corp.neo-m.jp/report/investigation/life_080_2026trends

-

Neo Marketing Official Website: https://corp.neo-m.jp/