- Otoshidama: Amounts Received and Spendable Limits

- Evolving Payment Methods: Cash Still King, But Digital on the Rise

- The Dawn of Young Investors: Interest in “Increasing” Money

- Savings Lead, Hobbies Follow: Popular Spending Choices

- Expert Insight: Balancing Future Investment with Present Joy

- The Future of Financial Literacy and Kawaii Culture

Otoshidama: Amounts Received and Spendable Limits

The survey, which has been conducted annually by CoroCoro Comic, revealed that the most common amount of Otoshidama received by elementary school students falls between “10,001 yen and 20,000 yen,” accounting for approximately 30% of the total. This trend of receiving around 10,000 yen has remained consistent over recent years.

However, the amount children are allowed to spend freely is considerably less. Approximately 70% of students reported being able to spend 5,000 yen or less, with “3,001 yen to 5,000 yen” being the most frequent range (25.7%). A significant portion, over 10%, indicated they were allowed to spend “0 yen,” implying that their entire Otoshidama is allocated to savings. This suggests that many families encourage financial independence while also setting appropriate boundaries for spending.

Evolving Payment Methods: Cash Still King, But Digital on the Rise

While cash remains the overwhelming preference for receiving Otoshidama, with 97.2% of respondents indicating this method, the survey highlighted an emerging diversification in payment. Some children reported receiving money via “bank transfer” (1.8%), “smartphone payment apps like PayPay” (0.3%), or “prepaid cards” (0.9%), alongside “gift certificates (e.g., book cards, QUO cards)” (5.1%). This indicates a gradual shift towards more varied financial transaction methods in Japanese households.

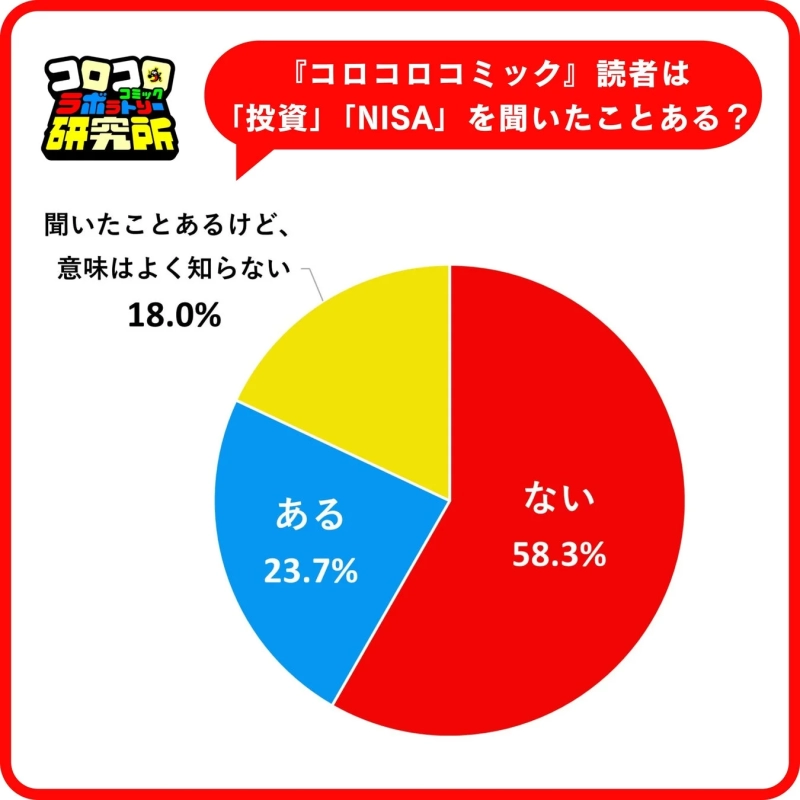

The Dawn of Young Investors: Interest in “Increasing” Money

A particularly striking finding from the survey is the growing interest in financial growth. When asked if they had heard terms like “investment” or “NISA” (Nippon Individual Savings Account, Japan’s tax-advantaged investment scheme), 23.7% responded “yes,” and another 18.0% said “yes, but I don’t know what it means.” This means a total of 41.7% of children have already been exposed to financial terminology. This exposure is likely influenced by increased parental discussions and the spread of financial education in schools.

Even more compelling, 60.6% of students expressed interest in “increasing” their Otoshidama rather than just “spending” it, with 24.6% showing “strong interest” and 36.0% showing “some interest.” This suggests a potential for future engagement in investment activities among this young demographic.

Savings Lead, Hobbies Follow: Popular Spending Choices

Despite the growing interest in financial growth, “savings” remains the top choice for how elementary school students use their Otoshidama. This indicates a strong sense of planned money management. Following savings, popular hobbies and entertainment items are common expenditures:

-

1st: Savings (37.3%)

-

2nd: Beyblade X (23.2%)

-

3rd: CoroCoro Comic (16.8%)

-

4th: Pokémon Cards (13.6%)

-

5th: Crane Games (12.4%)

These choices highlight a balance between prudent financial habits and the desire to enjoy popular cultural items and engaging activities.

Expert Insight: Balancing Future Investment with Present Joy

Koichi Kobayashi, Director of the CoroCoro Comic Research Institute, offered his perspective on these fascinating trends.

“This survey reveals that elementary school students are starting to look beyond ‘money to be spent’ and towards ‘money to be nurtured by themselves.’ The increasing mentions of terms like NISA in family conversations and in classrooms show a definite spread of a positive attitude towards learning about financial mechanisms. At the same time, they are fully enjoying investments in their favorite hobbies and ‘oshi-katsu’ (fandom activities). This uniquely CoroCoro reader sensibility of balancing ‘investment in their future selves’ with ‘current excitement’ is alive and well.”

The CoroCoro Comic Research Institute, launched by Shogakukan, aims to analyze the real-world experiences of elementary school students, drawing on reader survey data collected since the magazine’s founding in 1977. This project seeks to create new value by bridging entertainment and education, including initiatives in local revitalization and edutainment. For more information, visit CoroCoro Comic Research Institute.

The Future of Financial Literacy and Kawaii Culture

The findings from this survey paint a compelling picture of a generation that is not only immersed in the vibrant world of Japanese pop culture, as evidenced by their spending on Beyblade X and Pokémon Cards, but also growing increasingly sophisticated in their understanding of personal finance. This dual interest in both “current excitement” and “future investment” could signify a new dimension for how Kawaii culture evolves globally. As these children grow, their financial savviness may influence how they engage with and invest in their favorite characters and brands, potentially creating more sustainable and interactive fan economies. This blend of playful engagement and practical financial thinking highlights a unique aspect of Japan’s youth culture, offering valuable insights for understanding future consumer trends and the global spread of financial education.

Relevant links: