Japan’s Beauty Secrets Revealed: Influencers Point to Skincare as the Next Big Thing

What Japanese products deserve more global recognition? This intriguing question was posed to 176 Japan-loving overseas nano and micro-influencers in a recent survey conducted by “PEPPER LIKES,” an overseas influencer matching service operated by LIFE PEPPER Inc. The resounding answer points to Japanese cosmetics, with skincare topping the list, followed by sweets and beverages.

The findings highlight a significant opportunity for Japan’s beauty industry to expand its international footprint, especially as inbound tourism continues to be a crucial driver for the domestic economy. As domestic growth faces challenges like an aging population, the global appeal of Japanese products, amplified by a favorable exchange rate for exports, becomes ever more vital.

The Growing Influence of Inbound Shoppers in Japan’s Cosmetics Market

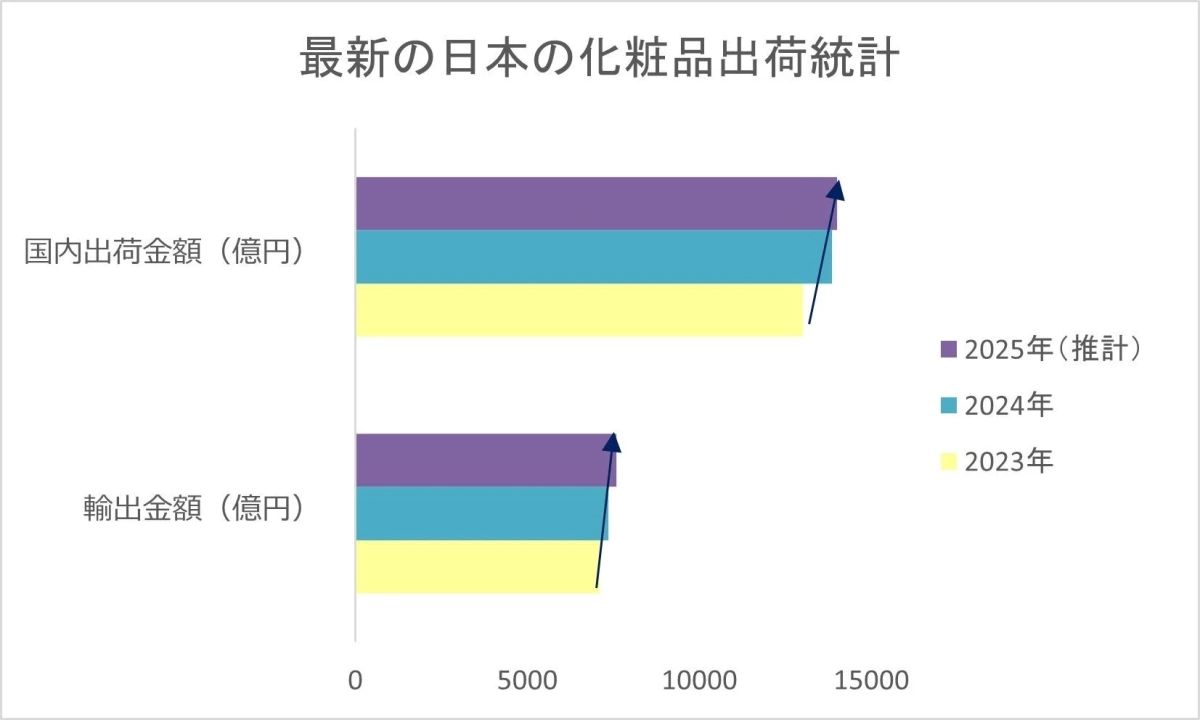

Japan’s overall industrial market and its cosmetics sector have shown modest growth post-pandemic, as illustrated by recent statistics. While the general industry sees a slight recovery in both domestic shipments and overseas exports,

the cosmetics market mirrors this trend, with both domestic and export figures showing a gradual upward trajectory.

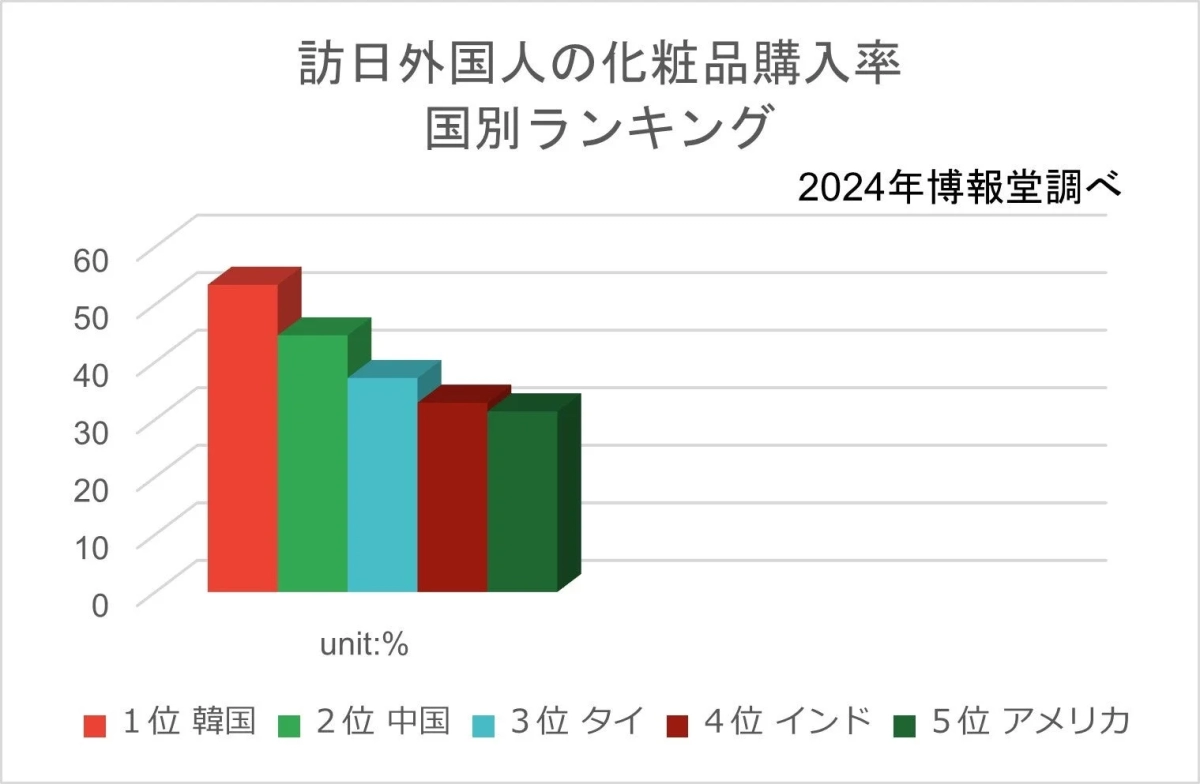

Inbound visitors represent a substantial 20% of the total cosmetics market, according to the Japan Cosmetic Industry Association. With an anticipated decrease in the domestic cosmetics-using population from 2025 onwards, purchases by international visitors are expected to significantly influence the market’s growth rate. A 2024 survey by Hakuhodo further revealed that cosmetics constitute a significant portion of inbound visitors’ shopping expenditures, with travelers from South Korea, China, and Thailand leading the charge. For instance, over 53.4% of South Korean visitors’ shopping budget is allocated to cosmetics.

What Japanese Products Are Influencers Raving About?

The survey, conducted from June to July 2025, gathered insights from 176 foreign men and women aged 20s to 50s, hailing from 26 countries. These nano to micro-influencers, active on platforms like Instagram, TikTok, YouTube, RED, and Facebook, were asked: “What Japanese products do you think should be more widely known overseas? (Product names and brands are welcome)”

The top category was unequivocally cosmetics, primarily skincare. Influencers frequently mentioned brands like Kao (Biore Cooling Series, Curel Intensive Moisture Series), Shiseido (Anessa Perfect UV Milk, Power Whitening Mask), SK-II (Facial Treatment Essence), Rohto Pharmaceutical (Melano CC Series), athletia (Core Balance Oil), and SHIRO (Savon Hand Serum, Eau de Parfum). It’s not just high-end brands like Shiseido that capture attention; mid-range products from Kao and Rohto Pharmaceutical are also highly valued for their effectiveness.

Further analysis revealed three distinct trends in the preferred Japanese skincare products:

-

Specialization in Seasonal Concerns: Products addressing challenges unique to Japan’s humid climate, such as cooling series for heat and UV care/whitening products for sun protection, received high praise. This emphasis was particularly noted as the survey took place during the summer months.

-

Addressing Serious Skin Concerns: Curel’s sensitive skin line garnered significant appreciation, particularly among European and American influencers. Rohto Pharmaceutical’s Melano CC, while marketed for whitening in Japan, is specifically noted by inbound visitors for its effectiveness in treating acne scars.

-

Focus on Natural and Unique Japanese Ingredients: Products featuring indigenous Japanese components such as Ashitaba leaf, Shiso leaf extract, rice fermentation liquid (athletia), and sake fermentation yeast (SK-II’s Pitera) are highly regarded for their natural efficacy.

The “Strategic Spending” of J-Beauty Enthusiasts

Overseas consumers, especially those from countries like South Korea, China, and the US, demonstrate a highly researched approach to purchasing cosmetics. A significant 72% investigate product ingredients, and over 60% examine ingredient origin before their trip, utilizing platforms like CosIng (EU), ChinaCosIng (China), and Hwahae (Korea). This pre-trip research is then deepened by consulting Japan-savvy influencers. A 2024 Hakuhodo survey indicates that for cosmetic lovers in China, South Korea, the US, Thailand, and India, the decision to purchase is overwhelmingly made before their visit.

This behavior pattern suggests that cosmetics are not impulse buys or mere souvenirs; they represent a “strategic expenditure.” Visitors meticulously curate their shopping lists, investing in products they believe offer true value. This discerning approach underscores the need for brands to build strong online presences and engage effectively with potential customers long before they set foot in Japan.

PEPPER LIKES aims to elevate the market value of Japanese skincare cosmetics by leveraging the authentic voices and analytical prowess of Japan-loving overseas influencers. These insights foster a sense of familiarity with Japanese skincare products, enhance brand image, and ultimately contribute to market revitalization driven by inbound tourism. The platform believes that overseas consumers, disillusioned by high-risk, high-return foreign products, now embrace “J-Beauty” as a “savior” for its safety and gentle efficacy. Japanese skincare, designed for challenging climates, offers solutions for global environmental changes and prioritizes safety with strict regulations and quality control.

PEPPER LIKES x Research: Tapping into Influencer Insights

To further support businesses in their global expansion, PEPPER LIKES has launched a new service, “PEPPER LIKES x Research.” This unique offering gathers authentic feedback from overseas users through its extensive network of over 30,000 nano and micro-influencers across multiple countries and genres. The service allows businesses to directly ask influencers questions such as “Which products would be well-received?” or “How should we communicate our message?” Influencers, being trend-savvy, provide valuable insights into popular items, effective presentation methods, and consumer information sources.

Key benefits of this research service include:

-

Gathering “overseas-centric” information that resonates with local audiences.

-

Receiving expert answers from professionals who deeply understand social media.

-

Conducting both quantitative surveys and in-depth qualitative interviews.

-

Obtaining creative proposals directly from influencers.

-

The option to commission PR work from favorite influencers.

One cosmetics brand successfully utilized PEPPER LIKES to achieve a 2.5 times higher Conversion Rate (CVR) compared to traditional advertising. By engaging influencers to meticulously explain the unique features of a hot cleansing gel—its ability to warm the skin, remove pore impurities, and moisturize—the brand garnered 1,800 likes and 337 shares in a single post, significantly boosting product understanding and awareness in Asian markets like Taiwan and Singapore.

PEPPER LIKES is committed to tracking inbound visitors’ purchasing journeys from their pre-trip decision-making through their social media interactions with influencers, and even to repeat purchases after returning home. By doing so, it aims to bolster Japan’s international competitiveness. Businesses interested in leveraging these insights can learn more at https://www.pepperlikes.jp.

As J-Beauty continues to captivate global audiences with its unique blend of innovation, natural ingredients, and a strong emphasis on safety and efficacy, services like PEPPER LIKES will surely play an increasingly vital role in shaping the future of ‘Kawaii’ beauty culture abroad, transforming casual interest into strategic, informed consumption.